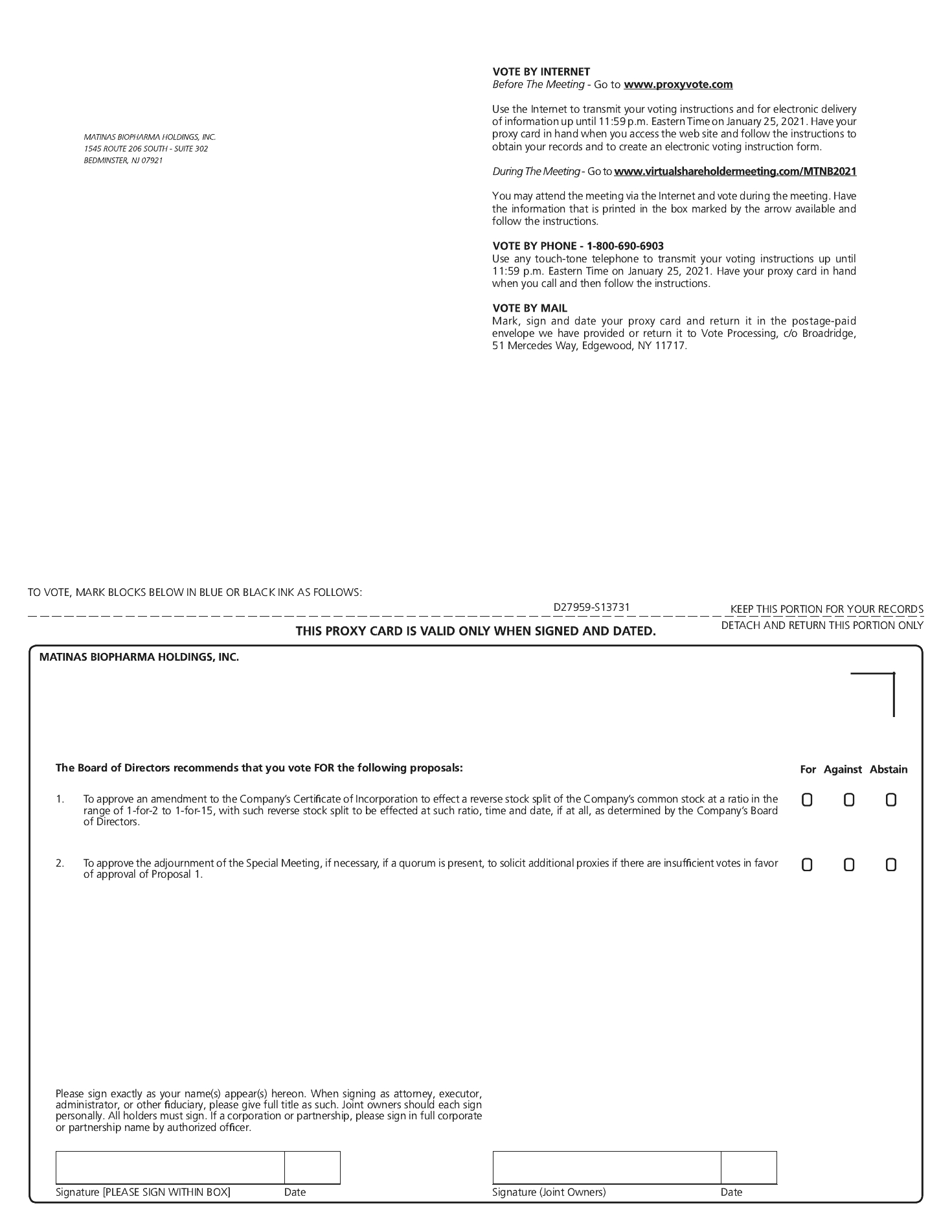

Moreover, we may in the future determine that submission of an application to the New York Stock Exchange or The NASDAQ Stock Market for “uplisting” of our Common Stock is in the best interest of our shareholders. The New York Stock Exchange and each tier of the Nasdaq has its own listing criteria. We may in the future consider targeting the New York Stock Exchange or NASDAQ Global Market, both of which require, among other criteria, an initial bid price of at least $4.00 per share and, following initial listing, maintenance of a continued price of at least $1.00 per share. On the record date, the sale price of our common stock on the

boardNYSE American was $1.04 per share. A decrease in the number of

directorsissued and outstanding shares of

Pharmasset, Inc. (chairman), Savient Pharmaceuticals, Inc., (NASDAQ: SVNT) Dura Pharmaceuticals, Inc., UroCor, Inc., GenVec, Inc. (NASDAQ: GNVC) (chairman), Sicor, Inc., Bone Care International, Inc. (chairman), Sapphire Therapeutics, Inc. (chairman), the medical advisory board of Henry Schein Inc. (NASDAQ: HSIC), and he was a Director and Co-Founder of Reliant. Pharmasset was acquired by Gilead Sciences, Inc. for $11 billion in 2011. He received B.S. and M.S. degreesour common stock resulting from the

Brooklyn Collegereverse stock split should, absent other factors, assist in ensuring that our per share market price of

Pharmacy and an honorary Doctorate in Humane Letters from Long Island University. We believe Mr. Conrad is qualified to serve on our

board of directors due to his extensive expertise and experience incommon stock remains above the

life sciences industry and his extensive board experience.Roelof Rongen See description under “Management.”

Eric Ende has served on our board of directors since April 2017. Dr. Ende is president of Ende BioMedical Consulting Group,required price. However, we cannot provide any assurance that (i) we will pursue a privately-held consulting company which is focused on helping life sciences companies raise capital, identify licensing partners, and optimize corporate structure as well as analyzing both private and public investment opportunities for clients within the life sciences industry, a position he has held since 2009. Dr. Ende serves as co-founder, chief executive and chief financial officer of WellFit Holdings, LLC, a private company focused on developing fitness technologies. In addition, Dr. Ende consulted with Icahn Enterprises in their efforts to appoint board members at Forest Labs, Genzyme, Biogen IDEC, and Amylin. Dr. Ende servedlisting on the boardNew York Stock Exchange, the Nasdaq Global Market, or any other tier of directors and as a member ofThe NASDAQ Stock Market or (ii) even if we do, our minimum bid price would remain over the audit and risk management committee of Genzyme Corp. (NASDAQ: GENZ) from 2010 until it was acquired by Sanofi (NSYE: SNY) in 2011. Dr. Ende is currently serving on the Technology Transfer Committee of Mount Sinai Innovation Partners and served as the Chairman of the Unsecured Creditor’s Committee overseeing the bankruptcy of Egenix, Inc. From 2002 through 2008, Dr. Ende was the senior biotechnology analyst at Merrill Lynch. From 2000 through 2002, Dr. Ende was the senior biotechnology analyst at Banc of America Securities and, from 1997 to 2000, he was a biotechnology analyst at Lehman Brothers. Dr. Ende received an MBA in Finance & Accounting from NYU – Stern Business School in 1997, an MD from Mount Sinai School of Medicine in 1994, and a BS in Biology and Psychology from Emory University in 1990. We believe Dr. Ende is qualified to serve on our board of directors due to his industry experience, including as president of Ende BioMedical Consulting Group and as a biotechnology analyst, and his prior public company board experience.

Stefano Ferrari has served on our board of directors since July 2013 and as a director of Matinas BioPharma since October 2012. Mr. Ferrari is the CEO and a director of Prime Acquisition Corp., a private equity fund focusing on real estate and renewable energy, a position he has held since October 2013. He is also the founder and managing member of Chestnut Hill Sciences, LLC (2004), a human and animal health care company dedicated to the development of dietary supplements, including omega-3 based products. He is the founder of Murami Pharma, Inc. (“Murami”) and has served as its CEO since its inception in 2011. Murami is a biopharmaceutical development stage company focusing on small-peptide therapeutics. Prior to Murami, Mr. Ferrari was the CEO of Bioseutica B.V. (2008-2011), a multinational holding company comprising KD-Pharma, a leading manufacturer of omega-3-concentrates, and the leading lysozyme manufacturers Fordras and Neova Technologies, amongst others. Over the last 17 years, Mr. Ferrari was founder, common shareholder and senior executive of several multinational companies operating in the pharmaceutical, food and ingredients industries. Besides Bioseutica, these companies include Prospa B.V. (1995-2002), a multinational holding company in the pharmaceutical industry, Fordras S.A. (2002-2008), ProAparts Lda (2001-2012), and Societa Prodotti Antibiotici S.p.A., the Italian pharmaceutical company that developed and marketed polyene antifungal medications. Mr. Ferrari has served on several boards, including Ikonisys Inc., Carigent Therapeutics, Inc., The Richard B. Fisher Center for Performing Arts, and St. Simeon Lda, a private family fund. He has 25 years of experience in investing in diverse industries, including real estate, pharmaceuticals, and media and entertainment. Mr. Ferrari earned his B.A. degree in International Business Administration from the University of San Francisco. We believe Mr. Ferrari is qualified to serve on our board of directors due to his extensive expertise and experience in the development and marketing of polyene antifungal medications, his extensive contacts in the manufacturing industry related to omega-3 based products and also his M&A experience.

James S. Scibetta has served as a member of our board of directors since November 2013. Since July 2017, Mr. Scibetta has served as chief executive officer of Maverick Therapeutics, Inc., a privately-held, development stage immune-oncology company. From October 2015 through June 2017, Mr. Scibetta served as President and Chief Financial Officer of Pacira Pharmaceuticals, Inc. (NASDAQ: PCRX). Prior to that, Mr. Scibetta was the Chief Financial Officer of Pacira since 2008. Prior to joining Pacira in August 2008, he served as a consultant to Genzyme Corporation following the sale of Bioenvision Inc. (NASDAQ: BIVN) to Genzyme in 2007. From 2006 to 2007 Mr. Scibetta was CFO of Bioenvision. From 2001 to 2006, he was Executive Vice President and Chief Financial Officer of Merrimack Pharmaceuticals Inc. (NASDAQ: MACK). Mr. Scibetta has previously served on the board of directors at the following life sciences companies: Nephros Inc. (NASDAQ: NEPH), Merrimack Pharmaceuticals and Labopharm Inc. Prior to his executive management experience, Mr. Scibetta spent over a decade in investment banking where he was responsible for sourcing and executing transactions for a broad base of public and private healthcare and life sciences companies. He currently serves as a member of the board of directors and chairman of the audit committee of MonoSol Rx, Inc., a privately-held specialty pharmaceutical company. Mr. Scibetta received his Bachelor of Science in Physics from Wake Forest University and an MBA from the University of Michigan. We believe Mr. Scibetta is qualified to serve on our board of directors because of his extensive management experience in the pharmaceutical industry, his investment banking experience and his experience as a chief financial officer and audit committee member of several publicly traded companies.

Adam Stern has served as a member of our board of directors since July 2013. Mr. Stern has been the head Private Equity Banking at Aegis Capital Corp. and CEO of SternAegis Ventures since 2012 and became one of our directors in July 2013. Prior to Aegis, from 1997 to November 2012, he was with Spencer Trask Ventures, Inc., most recently as a Senior Managing Director, where he managed the structured finance group focusing primarily on the technology and life science sectors. Mr. Stern held increasingly responsible positions from 1989 to 1997 with Josephthal & Co., Inc., membersminimum bid price requirement of the New York Stock Exchange where he served as Senior Vice President and Managing Director of Private Equity Marketing. He has been a FINRA licensed securities broker since 1987 and a General Securities Principal since 1991. Mr. Stern is a director of Dance Biopharm, Inc. Mr. Stern is a former director of InVivo Therapeutics Holdings Corp. (NASDAQ Global Market: NVIV), Organovo Holdings, Inc. (NASDAQ Global Market: ONVO), LabStyle Innovations Corporation (NASDAQ Capital Market: DRIO) and PROLOR Biotech Ltd., which was sold to Opko Health, Inc. (NASDAQ Global Select: OPK) for approximately $600 million in 2013. Mr. Stern holds a Bachelor of Arts degree with honors from the University of South Florida in Tampa. We believe Mr. Stern is qualified to serve on our board of directors because of his extensive experience in corporate finance with special emphasis on the life science industries.

There are no family relationships among any of our directors or executive officers.

Vote Required

Directors will be elected by a pluralitytier of the votes cast by the holders of our common stock voting in person or by proxy at the annual meeting. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will have no effect on the vote for election of directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE

ELECTION OF THE DIRECTOR NOMINEES.

Corporate Governance Matters

Board of Director Composition

Our board of directors currently consists of six members.We have no formal policy regarding board diversity. Our priority in selection of board members is identification of members who will further the interests of our stockholders through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape.

Board of Director Meetings

Our Board met twelve times in 2016. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such directors served on the Board) and (ii) the total number of meetings of all committees of our BoardNasdaq Stock Market on which the director served (during the periods for which the director served on such committee or committees). The Company does not have a formal policy requiring members of the Board to attend our annual meetings. Roleof Rongen and Herbert Conrad attended the 2016 Annual Meeting of Stockholders.

Director Independence

Our common stock is listed on the NYSE MKT. Our board of directors undertook a review of its composition, the composition of its committees and the independence of each director. Based on information requested from and provided by each of our directors, our board of directors has determined that Messrs. Herbert Conrad, Eric Ende, Stefano Ferrari and James Scibetta are “independent directors” as such term is definedwe may list.

In addition, in

the rules of The NYSE MKT’s corporate governance requirements and Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended.There are no family relationships among any of our directors or executive officers.

Board Committees

Our board of directors has three standing committees — an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee. The Audit Committee oversees and monitors our financial reporting process and internal control system, review and evaluate the audit performed by our registered independent public accountants and report to the Board any substantive issues found during the audit. The Audit Committee is directly responsible for the appointment, compensation and oversight of the work of our registered independent public accountants. The Audit Committee reviews and approves all transactions with affiliated parties. The Board adopted a written charter for the Audit Committee, which is available on our website. James Scibetta, Herbert Conrad, Eric Ende and Stefano Ferrari currently serve as members of the Audit Committee with James Scibetta, serving as its chairman. All of the members of the Audit Committee have been determinedorder to be financially literate and are considered independent directors as defined under The NYSE MKT’S listing standards and applicable SEC rules and regulations. Mr. Scibetta qualifies as an audit committee “financial expert” as that term is defined by Commission regulations.The Audit Committee met four times during 2016. Our Board has adopted an Audit Committee Charter, which is available for viewing at www.matinasbiopharma.com.

Compensation Committee. The Compensation Committee provides advice and makes recommendations to the Boardincluded in the areas of employee salaries, benefit programs and director compensation. The Compensation Committee also reviews the compensation of our executive officers, including our chief executive officer, and makes recommendations in that regard to the Board as a whole. The Board adopted a written charter for the Compensation Committee, which is available on our website. Stefano Ferrari, Herbert Conrad, Eric Ende and James Scibetta currently serve as members of the Compensation Committee, with Stefano Ferrari serving as its chairman. All of the members of the Compensation Committee are considered independent directors as defined under The NYSE MKT’s listing standards.The Compensation Committee met four times during 2016. Our Board has adopted a Compensation Committee Charter, which is available for viewing at www.matinasbiopharma.com.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee nominates individuals to be elected to the full Board by our stockholders. The Nominating and Corporate Governance Committee considers recommendations from stockholders if submitted in a timely manner in accordance with the procedures set forth in our Bylaws and applies the same criteria to all persons being considered. The Board adopted a written charter for the Nominating and Corporate Governance Committee, which is available on our website. Herbert Conrad, Eric Ende, Stefano Ferrari and James Scibetta currently serve as members of the Nominating and Corporate Governance Committee, with Herbert Conrad serving as its chairman. All of the members of the Nominating and Corporate Governance Committee are considered independent directors as defined under The NYSE MKT’s listing standards.The Nominating and Corporate Governance Committee met four times during 2016. Our Board has adopted a Nominating and Corporate Governance Charter, which is available for viewing at www.matinasbiopharma.com.

Stockholder nominations for directorships

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names and background to the Secretary of the Company at the address set forth below under “Stockholder Communications.” All such recommendations will be forwarded to the Nominating and Corporate Governance Committee, which will review and only consider such recommendations if appropriate biographical and other information is provided, as described below, on a timely basis. All security holder recommendations for director candidates must be received by the Company in the timeframe(s) set forth under the heading “Stockholder Proposals” below.

the name and address of record of the security holder;

a representation that the security holder is a record holder of the Company’s securities, or if the security holder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934;

the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five (5) full fiscal years of the proposed director candidate;

a description of the qualifications and background of the proposed director candidate and a representation that the proposed director candidate meets applicable independence requirements;

a description of any arrangements or understandings between the security holder and the proposed director candidate; and

the consent of the proposed director candidate to be named in the proxy statement relating to the Company’s annual meeting of stockholders and to serve as a director if elected at such annual meeting.

Assuming that appropriate information is provided for candidates recommended by stockholders, the Nominating and Corporate Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by members of the Board or other persons, as described above and as set forth in its written charter.

Board Leadership Structure and Role in Risk Oversight

The positions of our chairman of the board and chief executive officer are separated. Separating these positions allows our chief executive officer to focus on our day-to-day business, while allowing the chairman of the board to lead the board of directors in its fundamental role of providing advice to and independent oversight of management. Our board of directors recognizes the time, effort and energy that the chief executive officer must devote to his position in the current business environment, as well as the commitment required to serve as our chairman, particularly as the board of directors’ oversight responsibilities continue to grow. Our board of directors also believes that this structure ensures a greater role for the independent directors in the oversight of our company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our board of directors. Our board of directors believes its administration of its risk oversight function has not affected its leadership structure.

Although our bylaws do not require our chairman and chief executive officer positions to be separate, our board of directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. Our board of directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full board of directors, which has responsibility for general oversight of risks, and our standing board committees.

Our board of directors satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company. Our board of directors believes that full and open communication between management and the board of directors is essential for effective risk management and oversight.

Stockholder Communications

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Absent unusual circumstances or as contemplated by committee charters, and subject to advice from legal counsel, the Secretary of the Company is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the Board as he considers appropriate.

Communications from stockholders will be forwarded to all directors if they relate to important substantive matters or if they include suggestions or comments that the Secretary considers to be important for the Board to know. Communication relating to corporate governance and corporate strategy are more likely to be forwarded to the Board than communications regarding personal grievances, ordinary business matters, and matters as to which the Company tends to receive repetitive or duplicative communications.

Stockholders who wish to send communications to the Board should address such communications to: The Board of Directors, Matinas BioPharma Holdings, Inc., 1545 Route 206 South, Suite 302, Bedminster, NJ 07921, Attention: Secretary.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial and accounting officer, or persons performing similar functions. A copy of the code is posted on the corporate governance section of our website, which is located atwww.matinasbiopharma.com. If we make any substantive amendments to, or grant waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website.

Executive Officers

The following table sets forth certain information regarding our current executive officers:

| Name | | Age | | Position(s) | | Served as an

Officer

Since |

| Roelof Rongen | | 52 | | Chief Executive Officer and Director | | 2013 |

| Jerome Jabbour | | 43 | | President | | 2013 |

| Dominick M. DiPaolo | | 41 | | Senior Vice President of Quality and Regulatory Compliance | | 2017 |

| Abdel Fawzy, Ph.D | | 66 | | Executive Vice President, Pharmaceutical Development and Supply Chain | | 2013 |

| Gary Gaglione, CPA | | 65 | | Vice President of Finance and Accounting and Acting Chief Financial Officer | | 2013 |

| Douglas F. Kling | | 44 | | Senior Vice President for Clinical Development and Project Management | | 2015 |

| Raphael J. Mannino, Ph.D | | 70 | | Senior Vice President, Chief Technology Officer | | 2015 |

Our executive officers are elected by, and serve at the discretion of, our board of directors. The business experience for the past five years, and in some instances, for prior years, of each of our executive officers is as follows:

Roelof Rongen has served as our Chief Executive Officer and one of our directors since July 2013 and as President, Chief Executive Officer a co-founder and a director of Matinas BioPharma since April 2012. He was also the Founder and Chairman of Essential Fatty Acid Therapeutics LLC, a biotech company focused on the development of innovative fatty acid derivatives. Prior to Matinas BioPharma, Mr. Rongen was Executive Vice President North American Operations for Trygg Pharma AS (subsequently named EPAX AS) (2009-2012) and Vice President of Life Cycle Management and Intellectual Property at Reliant Pharmaceuticals, Inc., or Reliant (2000-2008). While at Reliant, Mr. Rongen held various earlier positions, including head of the Omacor®/Lovaza® launch team, Executive Director of Marketing for Lescol® and Executive Director of Business Development. Prior to Reliant, Mr. Rongen was also Global Product Director for Humira® at BASF Pharma (1998-2000), later acquired by Abbott Laboratories; a consultant at The Wilkerson Group in New York (1995-1998) and Arthur D. Little in Amsterdam (1990-1993), and a Research Fellow in biochemistry at Baylor University in Texas (1989-1990). Mr. Rongen earned an MBA from Kellogg GSM at Northwestern University in Evanston, Illinois, and a graduate degree in Molecular Sciences from Wageningen University in the Netherlands.

Jerome D. Jabbour, JD became our President during March 2016. Prior to that he served as our Executive Vice President, Chief Business Officer, General Counsel and Secretary since October 2013 and as one of our directors from April 2012 until November 2013. Mr. Jabbour is also a Co-founder of Matinas BioPharma. Prior to joining our management team, he was the Executive Vice President and General Counsel of MediMedia USA, or MediMedia, from 2012 to October 2013, a privately held diversified health care services company. Prior to MediMedia, he was the Senior Vice President, Head of Global Legal Affairs of Wockhardt Limited (2008-2012) and Senior Counsel and Assistant Secretary at Reliant (2004-2008). Earlier in his career, he held positions as Commercial Counsel at Alpharma, Inc. (2003-2004) and as a Corporate Associate at Lowenstein Sandler LLP (1999-2003). Mr. Jabbour earned his J.D. from Seton Hall University School of Law in New Jersey and a B.A. in Psychology from Loyola University in Baltimore.

Dominick M. DiPaolo has served as our Senior Vice President of Quality and Regulatory Compliance since April 18, 2017. Previously from October 2015 until April 2017, Mr. DiPaolo served as Senior Vice President of Quality, Compliance and Regulatory Affairs at Cyalume Technologies Holdings, Inc. (OTCQB: CYLU), a diversified pharmaceutical and medical device company. Prior to Cyalume, from August 2011 until July 2015, Mr. DiPaolo served as Senior Vice President, Quality, Compliance and Regulatory Affairs at Tris Pharma, a specialty pharmaceutical company of both branded and generic products. Prior to Tris Pharma, Mr. DiPaolo served as Vice President of Quality and Regulatory for G&W Laboratories, Inc., a niche pharmaceutical company. Earlier in his career, he held various senior quality positions at Barr Laboratories, Pfizer Inc., Novartis, Hoffmann-La Roche and Johnson & Johnson. Mr. DiPaolo is both a Certified Quality Engineer (“CQE”) as well as a Certified Quality Auditor (“CQA”) from the American Society for Quality. Mr. DiPaolo earned his B.S. in Biotechnology and Microbiology from Rutgers University in New Brunswick, New Jersey and completed his graduate course work in Microbiology at Seton Hall University in South Orange, New Jersey.

Abdel A. Fawzy, PhD has served as our Executive Vice President for Pharmaceutical and Supply Chain Development since July 2013 and as Executive Vice President for Pharmaceutical and Supply Chain Development of Matinas BioPharma since August 2011. Dr. Fawzy is a Co-Founder of Matinas BioPharma. Prior to Matinas BioPharma, Dr. Fawzy was a founder of expert consulting firm DeMelle BioPharma (2008-2012) and Executive Director Pharmaceutical Development at Reliant, from 2000 to 2008. Earlier in his career, Dr. Fawzy held pharmaceutical development positions at Ascent Pharmaceuticals, Inc. (1994-2000), DuPont (1990-1994) and Squibb Marsam Pharmaceuticals (1989-1990). He is the inventor on 15 published patents and patent applications all related to the healthbiotechnology and pharmaceutical developmenttrading indices and manufacturing processes. Dr. Fawzy received his Ph.D. in Pharmaceutical Technology from Tuebingen University in Germany, a Pharmacy degree from Temple University in Philadelphia, Pennsylvania, and a MS in Pharmaceutical Technology from the Cairo School of Pharmacy in Egypt.

Gary Gaglione, CPA has served asexchange-traded funds (ETFs), our Acting Chief Financial Officer, Vice President of Finance & Accounting since April 2013. Prior to joining us as a full time employee, Mr. Gaglione was President of MCM Consulting LLC from 2011 until October 2013. Prior to MCM Consulting, Mr. Gaglione was Senior Director of Finance at Shionogi USA, Inc. (2011). In 2009 and 2010, he was Vice President of Finance and Controller for Phytomedics, Inc. Prior to Phytomedics, he was Controller for ProStrakan Inc.’s U.S. operations. From 2001 to 2008, Mr. Gaglione was an Executive Director at Reliant, initially as head of Planning, Budgets and Analysis, then, from 2006 on, as head of Internal Audit and Sarbanes Oxley Compliance in preparation for a potential Reliant initial public offering. Before Reliant, he held numerous finance positions of increasing responsibility at the U.S. subsidiary of Hoffmann-La Roche Inc. (1976-2001),stock must meet certain eligibility requirements, including, Vice President of R&D Finance (1997-2001). He started his finance career at KPMG LLP (1974-1976). Mr. Gaglione earned a B.S. degree in Business Administration with a major in Accounting from Villanova University and an MBA in Finance from Seton Hall University.

Douglas F. Kling has served as our Senior Vice President for Clinical Development since March 12, 2015. Prior to Matinas, Mr. Kling held various positions at Omthera Pharmaceuticals, Inc. (acquired by AstraZeneca PLC in 2013) from August 2010 to December 2014, most recently as Senior Vice President of Clinical Development and Project Management. Prior to that, Mr. Kling served as Senior Director, Project Management at Shionogi USA Inc. (July 2009 to July 2010), as Senior Director, Program Management at The Medicines Company (April 2008 to July 2009) and in a variety of positions at Reliant (November 2000 to March 2008), most recently as Director, R&D Project Management. Mr. Kling earned his B.S. in biological sciences from Duke University and his M.B.A. from Rutgers Business School.

Raphael J. Mannino has served as our Senior Vice President and Chief Scientific Officer since September 2015. From 1990 until August 2015, Dr. Mannino was an Associate Professor of Pathology and Laboratory Medicine at Rutgers University, New Jersey Medical School. Dr. Mannino founded BioDelivery Sciences, Inc., and served as its President, Chief Executive Officer and Chief Scientific Officer and a member of its Board of Directors from 1995 to 2000, when it was acquired by BioDelivery Sciences International, Inc. (NASDAQ: BDSI). Dr. Mannino served as BDSI’s Executive Vice President and Chief Scientific Officer from 2001 to 2009 and a member of its Board of Directors from 2000 to 2007. Dr. Mannino’s previous experience includes positions as Assistant, then Associate Professor, Albany Medical College (1980 to 1990), and Instructor then Assistant Professor, Rutgers Medical School (1977 to 1980). His postdoctoral training was from 1973 to 1976 at the Biocenter in Basel, Switzerland. Dr. Mannino received his Ph.D. in Biological Chemistry in 1973 from the Johns Hopkins University, School of Medicine.

EXECUTIVE COMPENSATION

Summary Compensation Table – 2016

The following table presents information regarding the total compensation awarded to, earned by, or paid to our chief executive officer and the two most highly-compensated executive officers (other than the chief executive officer) who were serving as executive officers as of December 31, 2016 for services rendered in all capacities to us for the years ended December 31, 2016 and December 31, 2015. These individuals are our named executive officers for 2016.

| Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Option

Awards(1)

($) | | All Other

Compensation

($) | | Total

($) |

| Roelof Rongen | | | 2016 | | | | 283,750 | | | | 160,000 | | | | 116,250 | | | | — | | | | 560,000 | |

| Chief Executive Officer | | | 2015 | | | | 300,000 | | | | 132,000 | | | | 101,638 | | | | | | | | 533,638 | |

| Douglas F. Kling | | | 2016 | | | | 236,458 | | | | 100,000 | | | | 62,000 | | | | — | | | | 398,458 | |

| Senior Vice President, Clinical Development & Project Management | | | 2015 | | | | 198,840 | | | | — | | | | 145,602 | | | | — | | | | 344,442 | |

| Jerome D. Jabbour,President | | | 2016 | | | | 282,804 | | | | 90,000 | | | | 108,500 | | | | — | | | | 481,304 | |

| | | | 2015 | | | | 293,000 | | | | 90,750 | | | | 59,289 | | | | — | | | | 443,039 | |

___________

| (1) | Amounts reflect the grant date fair value of option awards granted in 2016 and 2015 in accordance with Accounting Standards Codification Topic 718. These amounts do not correspond to the actual value that will be recognized by the named executive officers. |

Narrative Disclosure to Summary Compensation Table

Employment Agreements with Our Named Executive Officers

Rongen

On July 30, 2013 we entered into an employment agreement with Mr. Rongen for a period of three years. Under the terms of Mr. Rongen’s employment agreement, he received a signing bonus of $150,000 and will receive a base salary of $300,000 per year. In addition, Mr. Rongen will also be eligible to receive an annual bonus, which is targeted at 40% of his base salary but which may be adjusted by our Compensation Committee based on his individual performance and our performance as a whole. Mr. Rongen may also be eligible to receive option grants at the discretion of our Compensation Committee. In October 2013, Mr. Rongen received a grant of 350,000 options at an exercise price of $0.94 per share. The options vest in equal monthly installments over three years from August 1, 2013. If we terminate Mr. Rongen’s employment without cause or Mr. Rongen resigns with good reason, we are required to pay him a severance of up to twelve months of his base salary plus benefits. In addition, the vesting of his outstanding options will be accelerated by six months upon such termination. If we terminate Mr. Rongen’s employment without cause during the 24 month period immediately following a change of control or Mr. Rongen resigns with good reason during the 24 month period immediately following a change of control, we are required to pay him a severance of up to eighteen months of his base salary and his target annual bonus plus benefits. In addition, his outstanding options would vest in full upon such termination. Mr. Rongen’s employment agreement provides for an increase in base salary of $50,000 annually, upon a future closing of an additional round of financing of at least $15 million and the initiation of the first Phase III study of MAT9001. Mr. Rongen will also be subject to a customary non-disclosure agreement, pursuant to which Mr. Rongen has agreed to be subject to a non-compete during the term of his employment and for a period of eighteen months following termination of his employment. As part of our cost reduction measures, we have entered into a letter agreement with Mr. Rongen effective as of April 1, 2016 that provides for, among other things, a 10%minimum daily trading volume and bid price standards. As noted above, we believe that the reduction in base salary through December 31, 2016the number of issued and a requirement that the executive contribute 20% of the applicable premium cost for healthcare coverage under the Company’s group health plan. The letter agreement also provides that for purposes of calculating any severance payments, the base salary will be the base salary prior to such temporary reduction and therefore the temporary reduction in base salary will not impact the amounts that would be paid to the executive if his employment was terminated. Effective October 1, 2016, the Board restated Mr. Rongen’s salary to its level prior to the 10% reduction.

On February 21, 2017, the Compensation Committee of the Board approved for Mr. Rongen an annual salary of $400,000 effective March 1, 2017 and target bonus of 50%. On March 27, 2017, Matinas BioPharma Holdings, Inc. (the “Company”) entered into a new employment agreement with its chief executive officer, Roelof Rongen, with the terms effective as of March 1, 2017. Under the terms of Mr. Rongen’s employment agreement, he will receive a base salary of $400,000 per year, subject to periodic adjustments as determined by our Board or Compensation Committee. In addition, Mr. Rongen will also be eligible to receive an annual bonus, which is targeted at 50% of his base salary based on his individual performance and our performance as a whole, however the achievement of the performance criteria will be determined by our Board or Compensation Committee. Mr. Rongen received an annual bonus of $160,000 for his performance during fiscal 2016. Mr. Rongen may also be eligible to receive option grants or other equity awards at the discretion of our Compensation Committee. In February 2017, Mr. Rongen received a grant of 600,000 options to purchaseoutstanding shares of our common stock at an exercisecaused by the reverse stock split, together with the anticipated increased stock price immediately following and resulting from the reverse stock split, should, absent other factors, assist in meeting such requirements. However, we cannot provide any assurance that we will meet any such index or ETF standards or that our common stock will ever be included in any such indices or ETFs following the reverse stock split.